Picture this: You’re excited about opening a new bank account after finding better interest rates online. Instead of a quick signature, you’re handed a stack of forms and asked for multiple documents. Sound familiar? Welcome to the world of KYC – a process that’s become as common as your morning coffee for anyone dealing with financial services today.

Whether you’re sending money abroad, opening a cryptocurrency account, or simply switching banks, understanding KYC can save you time, frustration, and potentially money. I’ve navigated countless KYC processes myself, and I’m here to break down everything you need to know in simple terms.

Understanding KYC: What Does Know Your Customer Really Mean?

KYC’s meaning goes far beyond just collecting your documents. Know Your Customer is a regulatory framework that requires financial institutions to verify your identity, understand your financial behavior, and assess potential risks before providing services. Think of it as a digital handshake that builds trust between you and your bank.

The concept isn’t new – banks have always needed to know their customers. However, modern KYC evolved dramatically after the 9/11 attacks when governments worldwide realized how easily criminals could exploit financial systems. Today’s KYC process combines traditional verification with cutting-edge technology to create a comprehensive security net.

Here’s what makes KYC different from simple identity verification:

- Ongoing monitoring: Unlike a one-time check, KYC continues throughout your relationship with the institution

- Risk assessment: Your profile gets categorized based on various factors like income, transaction patterns, and geographical location

- Regulatory compliance: Banks must follow specific rules or face hefty penalties

The KYC vs AML Connection

You’ll often hear KYC vs AML (Anti-Money Laundering) mentioned together, but they serve different purposes. While KYC focuses on knowing who you are, AML monitors what you do with your money. They work hand-in-hand – KYC provides the foundation, and AML builds the monitoring system on top.

Why KYC Matters: The Critical Importance You Should Know

Understanding why KYC exists helps you appreciate its necessity rather than viewing it as a bureaucratic hassle. The numbers tell a compelling story:

- Money laundering: Criminals wash approximately $2-5 trillion annually through the global financial system

- Penalties: Banks paid over $10 billion in AML-related fines in 2023 alone

- Fraud prevention: Proper KYC reduces financial fraud by up to 70%

Personal Benefits of KYC

While KYC might seem like it only benefits banks, you actually gain several advantages:

Enhanced Security: Your accounts become significantly harder for criminals to access or impersonate. I’ve seen cases where robust KYC prevented unauthorized account openings using stolen identities.

Better Service: Banks can offer personalized products when they understand your financial profile. This means better loan rates, investment options, and customer service.

Global Access: Proper KYC documentation enables you to access international money transfer services and banking facilities worldwide without repeated verification.

The Complete KYC Process: Step-by-Step Guide

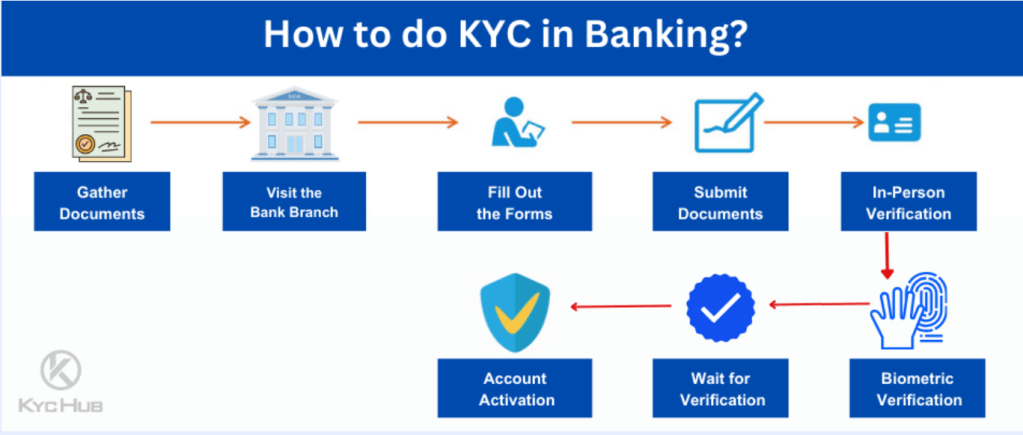

Let me walk you through the typical KYC process steps you’ll encounter:

Source: kychub

Step 1: Customer Identification Program (CIP)

This initial phase involves collecting basic information about you. Banks need to verify four key elements:

- Name: Full legal name as it appears on government documents

- Date of birth: For age verification and identity confirmation

- Address: Current residential address for correspondence

- Identification number: Social Security Number, passport number, or similar

Step 2: Document Verification

Here’s where you’ll provide the actual KYC documents needed:

| Document Type | Examples | Purpose |

|---|---|---|

| Identity Proof | Passport, Driver’s License, National ID | Confirms who you are |

| Address Proof | Utility bills, Bank statements, Rental agreements | Verifies where you live |

| Income Proof | Salary slips, Tax returns, Bank statements | Assesses financial capacity |

Step 3: Customer Due Diligence (CDD)

Banks dig deeper into your background during this phase. They’ll check:

- Credit history: Your borrowing and repayment track record

- Employment status: Current job and income stability

- Transaction patterns: Expected account activity based on your profile

Step 4: Risk Assessment and Categorization

You’ll be placed into one of these risk categories:

- Low Risk: Regular salary earners with simple banking needs

- Medium Risk: Business owners or high-income individuals

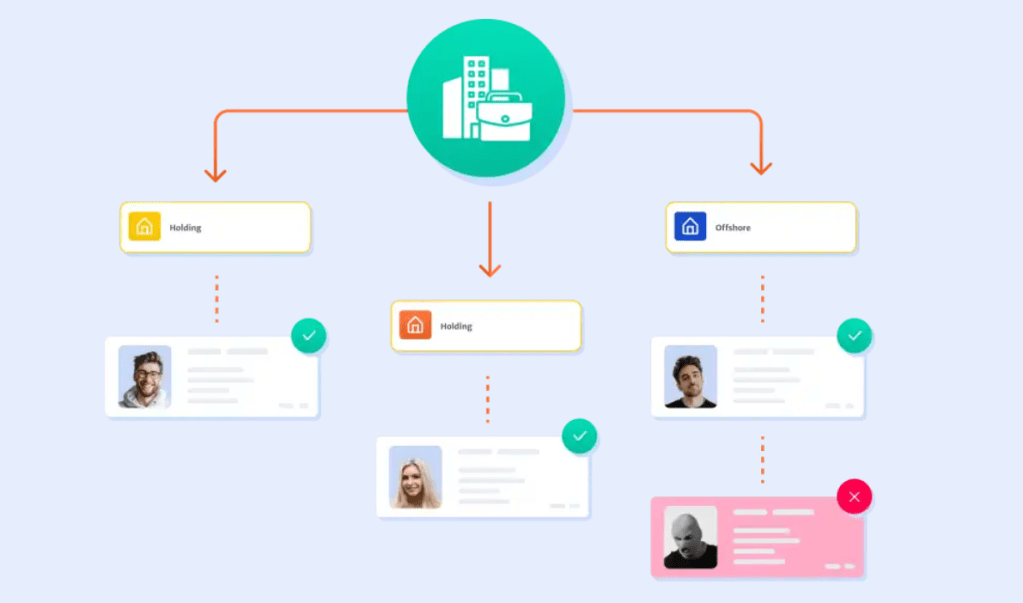

- High Risk: Politically exposed persons or complex financial structures

KYC Documentation: What You Actually Need to Provide

The KYC documents needed vary based on your situation, but here’s a comprehensive breakdown:

Individual Customer Requirements

Primary Documents (any one):

- Passport with photograph

- Driver’s license with photograph

- National identity card

- Voter ID card

Secondary Documents (supporting):

- Bank account statements (last 3 months)

- Utility bills (electricity, gas, water)

- Rental agreement or property documents

- Employment letter or salary certificate

Special Considerations for Different Scenarios

For Students: Many banks offer simplified KYC processes requiring just a college ID and parents’ documentation.

For NRIs (Non-Resident Indians): KYC challenges for NRIs include additional documentation like overseas address proof, visa copies, and sometimes consular verification.

For Senior Citizens: Banks often provide home visits or relaxed documentation requirements for elderly customers.

KYC in Banking: Your Everyday Financial Life

KYC in banking affects almost every financial service you use. Let me break down how different banking activities involve KYC:

Account Opening

Opening any new bank account triggers a complete KYC process. The KYC verification time typically ranges from 24 hours to 7 days, depending on:

- Complexity of your profile: Simple salary accounts process faster

- Document quality: Clear, readable documents speed up verification

- Bank’s technology: Digital banks often complete KYC within hours

Loan Applications

When applying for loans, banks conduct enhanced KYC that includes:

- Income verification: Detailed salary slips and tax returns

- Asset evaluation: Property documents if you’re pledging collateral

- Guarantor verification: KYC of co-signers or guarantors

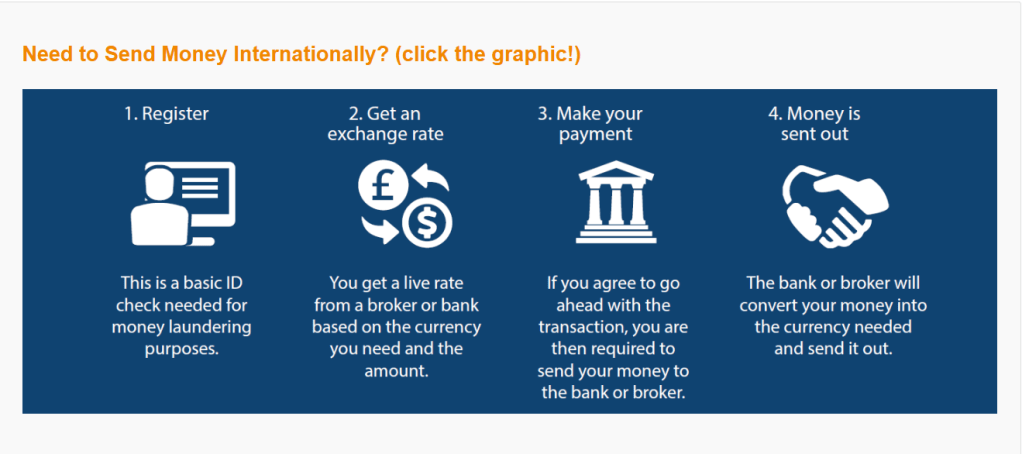

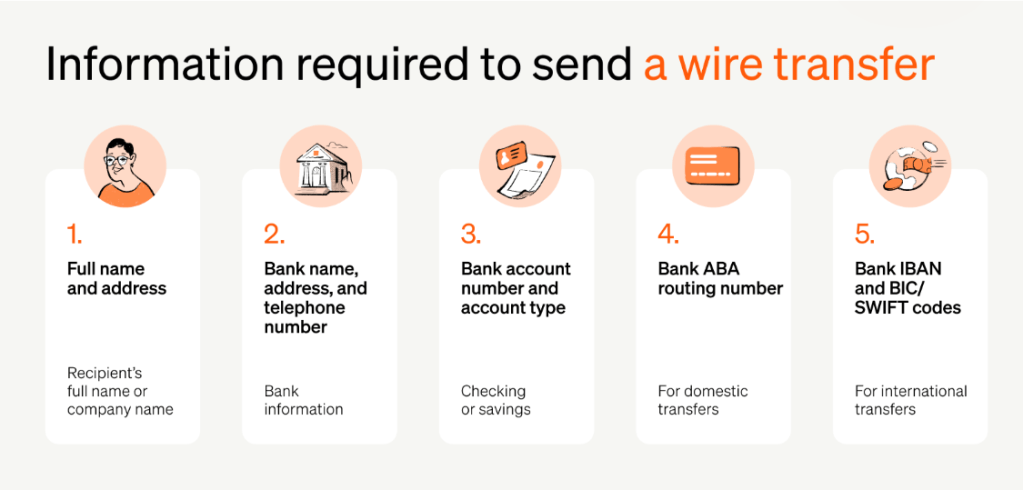

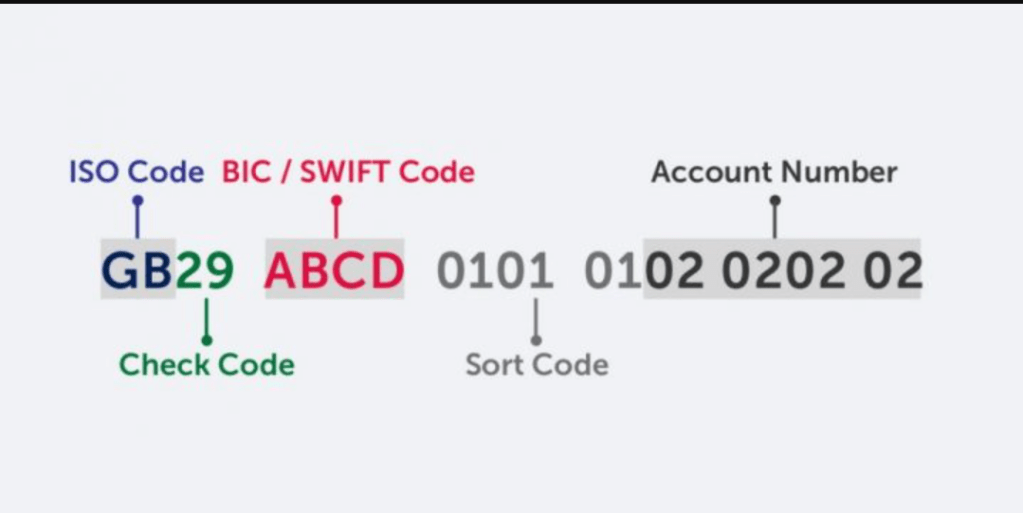

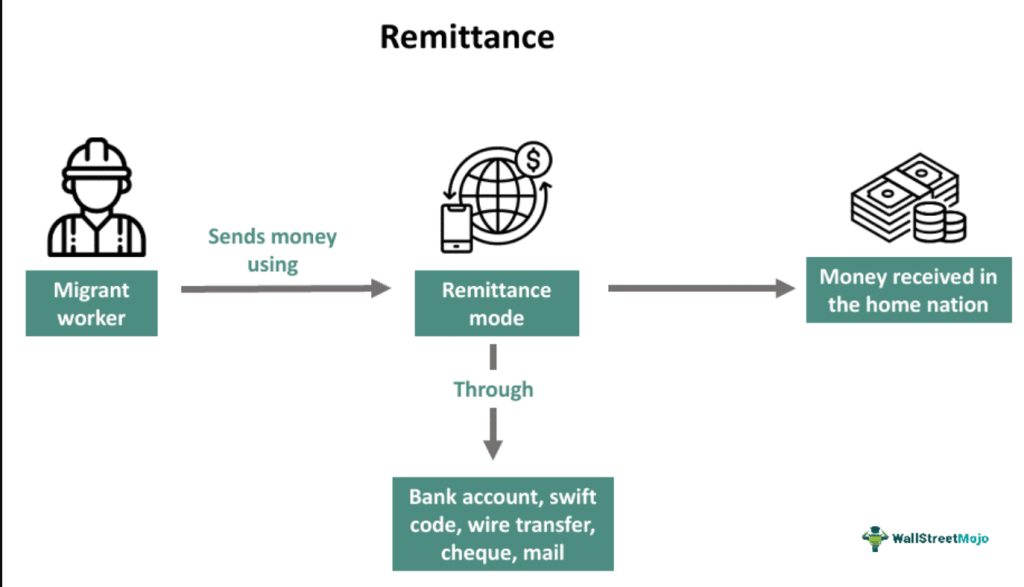

International Transactions

If you’re planning to send money abroad, banks require additional KYC documentation:

- Purpose of transfer: Invoice, education fees receipt, or medical bills

- Beneficiary details: Complete information about the recipient

- Source of funds: Proof of how you earned the money you’re sending

KYC for Cryptocurrency: The Digital Revolution

KYC for cryptocurrency has become increasingly important as digital assets enter mainstream finance. Crypto exchanges now implement KYC processes that often exceed traditional banking requirements.

Why Crypto KYC is Stricter

Cryptocurrency’s anonymous nature makes it attractive for money laundering, so regulators demand comprehensive verification:

- Enhanced documentation: Multiple forms of ID and address proof

- Source of funds: Detailed explanation of how you acquired crypto investments

- Transaction monitoring: Continuous surveillance of your trading patterns

The Crypto KYC Process

Here’s what you’ll encounter when signing up for a cryptocurrency exchange:

- Basic verification: Name, email, and phone number

- Identity verification: Photo ID and selfie verification

- Address verification: Utility bills or bank statements

- Enhanced verification: Income proof and source of funds documentation

Global KYC Regulations: What You Need to Know

KYC compliance regulations vary significantly across countries, but several international standards guide implementation:

Major Regulatory Frameworks

United States: The Bank Secrecy Act and USA PATRIOT Act form the foundation of US KYC requirements. Banks must implement Customer Identification Programs and maintain detailed records.

European Union: The Fifth Anti-Money Laundering Directive requires banks to identify beneficial owners and implement risk-based approaches to customer verification.

India: The Reserve Bank of India mandates different KYC levels – from basic accounts with simplified requirements to full KYC for comprehensive banking services.

Simplified KYC: Making the Process Easier

Recognizing that traditional KYC can be burdensome, many countries now offer simplified KYC processes for specific situations:

When You Can Use Simplified KYC

- Small account balances: Accounts with limited transaction amounts

- Government benefit recipients: Social security or pension beneficiaries

- Students: Educational institution verification

- Rural populations: Alternative documentation acceptance

Digital KYC Innovations

Modern technology has revolutionized KYC through:

- Video KYC: Face-to-face verification through video calls, eliminating branch visits

- Biometric Authentication: Fingerprint and facial recognition for instant verification

- AI-Powered Verification: Machine learning algorithms that detect fake documents and fraud attempts

Common KYC Challenges and How to Overcome Them

Based on my experience helping people navigate KYC processes, here are the most common challenges and solutions:

Source: kychub

Documentation Issues

Problem: Rejected documents due to quality or authenticity concerns

Solution: Ensure documents are:

- High-resolution scans or photos

- Clearly readable without shadows or glare

- Recent (typically within 3 months for address proof)

- Properly signed and stamped where required

Address Verification Problems

Problem: Difficulty proving an address for people who frequently move

Solution:

- Use bank statements from your previous address

- Obtain a letter from your employer confirming your current address

- Consider using a family member’s address with proper authorization

International Complications

Problem: Foreign documents are not accepted or require translation

Solution:

- Get documents translated by certified translators

- Use an apostille certification for international document authentication

- Provide additional supporting documentation

The Cost of KYC: What It Means for You

While you don’t directly pay for KYC, the costs ultimately affect the services you receive:

Hidden Costs You Bear

- Higher service fees: Banks pass KYC costs through increased charges

- Slower processing: Manual verification takes longer than automated systems

- Limited access: Some services become unavailable due to compliance complexity

The Value Proposition

Despite the costs, KYC provides significant value:

- Fraud protection: Reduces your risk of identity theft

- Better rates: Verified customers often receive preferential pricing

- Global access: Enables participation in the international financial system

Future of KYC: What’s Coming Next

The KYC landscape continues evolving rapidly, with several trends shaping its future:

Technological Advances

Blockchain-based Identity: Self-sovereign identity solutions that give you control over your personal data while maintaining privacy.

Artificial Intelligence: AI systems that can verify documents instantly and detect sophisticated fraud attempts.

Biometric Integration: Advanced biometric systems using voice patterns, gait analysis, and even DNA verification.

Regulatory Evolution

Global Standardization: International efforts to harmonize KYC requirements across borders.

Privacy Protection: Balancing verification needs with data protection requirements like GDPR.

Digital-First Approach: Regulations adapting to support fully digital verification processes.

Practical Tips for Smooth KYC Completion

Here’s my advice for making your next KYC process as painless as possible:

Before You Start

- Gather all documents: Collect everything you might need before beginning

- Check requirements: Verify specific requirements with your bank or service provider

- Plan timing: Allow extra time for verification, especially during busy periods

- Keep copies: Maintain digital copies of all submitted documents

During the Process

- Be honest: Provide accurate information – inconsistencies cause delays

- Ask questions: Don’t hesitate to clarify requirements with customer service

- Follow up: Check on your application status if you don’t hear back within the expected timeframes

- Stay organized: Keep track of submission dates and reference numbers

After Completion

- Update regularly: Inform your bank about address changes or other significant life events

- Monitor communications: Banks may request updated documentation periodically.

- Understand limitations: Know what services require additional verification

Conclusion: Mastering KYC for Your Financial Journey

Understanding KYC isn’t just about compliance – it’s about taking control of your financial life. Whether you’re opening your first bank account, planning to send money abroad, or exploring international money transfer services, knowing what to expect from the KYC process empowers you to navigate it confidently.

The key takeaways for your KYC journey:

- Prepare thoroughly: Gather all necessary documents before starting

- Stay informed: Understand the requirements for your specific situation

- Embrace technology: Use digital KYC options when available

- Plan ahead: Allow sufficient time for verification processes

- Keep records: Maintain copies of all submitted documents

As financial services continue evolving, KYC will become more sophisticated but also more user-friendly. The goal remains the same: creating a secure, trustworthy financial ecosystem that protects everyone involved.

Remember, KYC isn’t just a regulatory hurdle – it’s your gateway to secure, comprehensive financial services that can help you achieve your goals, whether that’s buying a home, starting a business, or simply managing your money more effectively. With the right preparation and understanding, you can turn what seems like a complex process into a straightforward step toward your financial future.

Frequently Asked Questions About KYC

What does KYC stand for?

KYC stands for “Know Your Customer.” It’s a regulatory requirement that mandates financial institutions to verify the identity of their customers and assess their risk profiles before providing services.

Why is KYC important in banking?

KYC is crucial in banking because it:

Prevents money laundering and terrorist financing

- Protects banks from regulatory penalties

- Reduces fraud and identity theft

- Enables banks to offer appropriate services based on customer risk profiles

- Maintains the integrity of the financial system

What documents are required for KYC?

The basic KYC documents needed include:

- Identity proof: Passport, driver’s license, or national ID card

- Address proof: Utility bills, bank statements, or rental agreements (within 3 months)

- Income proof: Salary slips, tax returns, or employment letters

- Photographs: Recent passport-size photos

Additional documents may be required based on your specific situation or the type of account you’re opening.

How often is KYC updated?

KYC updates are required:

- Periodically: Every 2-10 years, depending on your risk category

- When circumstances change: New address, job change, or significant life events

- For specific transactions: Large transfers or new service requests

- At the bank’s request, when suspicious activity is detected or regulatory requirements change

Is KYC mandatory for all bank customers?

Yes, KYC is mandatory for all bank customers. However, the level of verification may vary:

- Basic KYC: For small accounts with limited transaction amounts

- Full KYC: For regular banking services and higher transaction limits

- Enhanced KYC: For high-value accounts or politically exposed persons

How long does KYC verification take?

KYC verification time varies based on several factors:

- Digital banks: 1-24 hours for automated verification

- Traditional banks: 2-7 business days for manual processing

- Complex cases: Up to 15 days for enhanced due diligence

- International customers: 7-21 days due to additional verification requirements

Can I complete KYC online?

Yes, many banks now offer digital KYC processes that include:

- Online document upload

- Video verification calls

- Biometric authentication

- Digital signature acceptance

However, some banks may still require in-person verification for certain account types or high-risk customers.

What happens if I don’t complete KYC?

If you don’t complete KYC:

- Your account may be frozen or restricted

- You won’t be able to access certain banking services

- Large transactions may be blocked

- The bank may close your account after giving proper notice

- You may face difficulties opening accounts with other banks

Are there different KYC requirements for NRIs?

Yes, KYC challenges for NRIs include additional requirements such as:

- Overseas address proof

- Visa or immigration status documents

- Income proof from foreign employment

- Sometimes consular verification

- Additional documentation for certain investment products

How can I speed up my KYC process?

To accelerate your KYC verification:

- Submit high-quality, clear document scans

- Provide all required documents in one go

- Ensure all information is consistent across documents

- Respond quickly to any requests for additional information

- Use digital channels when available

- Choose banks with advanced digital KYC capabilities